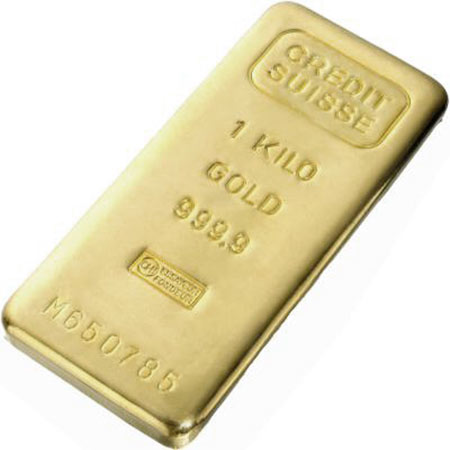

The Gold Bar

As speculation vehicles, gold bullion bars are picking up in ubiquity principally on the grounds that gold bars convey much lower premiums than gold bullion coins convey. Case in point, premiums on kilo gold bars can be as much as €40 every ounce lower than the premium on gold coins.

Genuinely, gold bars are an energising approach to put resources into gold. Hauling extensive gold bars very nearly causes an adrenalin surge. Constantly, individuals holding vast gold bars interestingly asked, “By what means can something so little be so heavy?” A gigantic measure of riches can be put away and covered in gold bullion bars.

While only a few years ago, just 10 ounce and 1 ounce gold bars were only accessible, currently a kilo-gold bar is regularly purchased by larger speculators. That is on account of kilo-gold bars being less demanding to store than the one ounce gold bars. In the same space it occupies when storing a quarter century ounce gold bars, six Royal Canadian-Mint kilo-gold bars (about 192.90 ounces) could easily be stored.

As a rule, small gold bars convey larger mark-ups over spot. Then again, normally the premiums on 100-gram gold bars are not exactly the premiums on the 10 ounce gold bar. The essential motivation to purchase gold bars rather than the prominent gold bullion coins is that gold bullion bars offer at smaller markups over spot than some of the well-known gold bullion coins.

100-gram, kilo, 10-oz and One-ounce gold bars, are qualified to be placed in IRAs (Individual Retirement Accounts) that acknowledge physical gold and silver items. To take in more about setting up a self-coordinated IRA that acknowledges gold and silver items, one should research ‘Putting Gold and Silver in IRAs’.

Speculators looking for low premium gold bars should consider the 100-gram gold bars, which convey premiums just marginally higher than kilo gold bars. Purchasing 100-gram bars gives speculators more adaptability when it comes to time to offer or sell.